Build Your Business’s Credit Rating With These Simple Steps

By Bashir on April 1, 2016

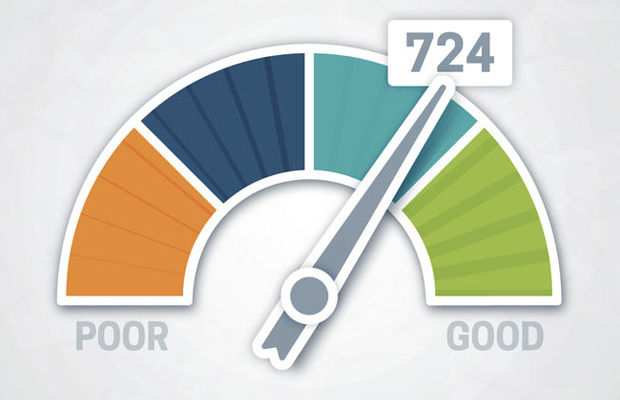

Credit score for businesses are just as important as credit rating for individuals. If your business doesn’t have a good rating, you will find it hard to secure finance. And, that is a bad position to be in because businesses aren’t always solvent. Sometimes, your capital will diminish, and you will need to an alternative form of cash flow. To prevent this problem from affecting your company, you need to maintain a healthy credit score. Below is a handful of tips that will come in handy.

Keep Your Information Current

There are three main bureaus that collect credit information and create credit rating. And, the sad news is that all three don’t use the same methods to collate your score. Each bureau is different, which means that each can give you a different score. You have no way of knowing which bureau a customer, a client or lender will use, so it’s important to keep up to date will all three. That way, you don’t have to worry about receiving a bad score and it affecting your business. Give them details of financial statements so that they have lots of detail to make a thorough prediction.

Make Payments Early Or On Time

Making an early payment is good for your credit score, but it might not be much good for your liquidity. For that reason, you might want to stay clear of making early payments because you never know when you will need the money. Still, you should always pay on time if you have any respect for your credit score. Paying on time shows the rating agencies that you are reliable and aren’t a risk of defaulting on your loan.

Weed Out The Problems

If your rating is starting to escalate, take preventive measures now before it’s too late. The last thing you want is for it to get out of hand because that is much harder to rectify. It is important to remember that a bad credit score isn’t a bad credit score for life. You can transform it into a good one – you just need to learn how. The obvious place to start is to pay off your debts, no matter how small. But, you can also get a credit card and build a positive score that way. If you want more tips, check out Crediful.com.

Clean Public Records

Anything that is public knowledge is also a mark on your rating. Everything from a lawsuit to filing for bankruptcy is bad for your score. And, it stays on for years, which means it is almost like a permanent black mark. If you can, avoid filing for bankruptcy where possible. Also, make sure you win any lawsuits that concern your finances or else you will pay for it with more than money.

All of the above are important factors to consider because they are what agencies use for their records.

Must See Posts

-

Sandra | May 15, 2024

Sandra | May 15, 2024

-

Brian | March 4, 2024

Brian | March 4, 2024

-

Brenda | February 5, 2024

Brenda | February 5, 2024

Apple Reportedly Planning To Buy AI Startup To Strengthen Vision Pro

-

David | February 5, 2024

David | February 5, 2024

Samsung Galaxy S24 & S24+ Review: A Taste Of Generative AI In Everyday Use

-

Phil Hackworth | February 5, 2024

Phil Hackworth | February 5, 2024

-

About TechGeek365

TechGeek365 is one of the MENA’s leading technology news platforms, producing & publishing content related to technology, gadgets, cybersecurity, social media & so much more!

We’re a team of young tech savvy individuals who work towards the one goal of bringing you, our amazing readers the best quality tech articles on the internet.

If you’re a young, tech savvy individual with extensive knowledge in any of the categories we write about and would like to join our growing team of authors, then send us an email and tell us a little more about yourself! We’d love to have you on board!

Advertise

Let’s put your brand in front of an audience that wants to listen! A number of advertising opportunities are available on TechGeek365, ranging from in-house custom campaigns to basic advertising solutions.

Custom campaign inquiries should be directed to: ads[at]techgeek365[dot]com

Trending Tags

Business Tips Advice Technology Social Media Random Mobiles Reviews Security Apple Google Facebook Featured Entrepreneurship Gadgets Science Mobile Apps Marketing SEO How-To Startups Android Video Hacking iPhone Microsoft Twitter BlackBerry Tech Infographic Cyber Security News Samsung Website Lebanon Whatsapp Design Instagram Online Business Viral

© 2024

© 2024

2 Comments